For our inaugural update, we have outlined below some market share data that illustrates how smaller, niche and asset-based markets are overlooked and access to these investments are underserved to the retail and RIA channel investors.

1) Asset-Based Lending Market Is Currently Underpenetrated, But Set to Grow Fast

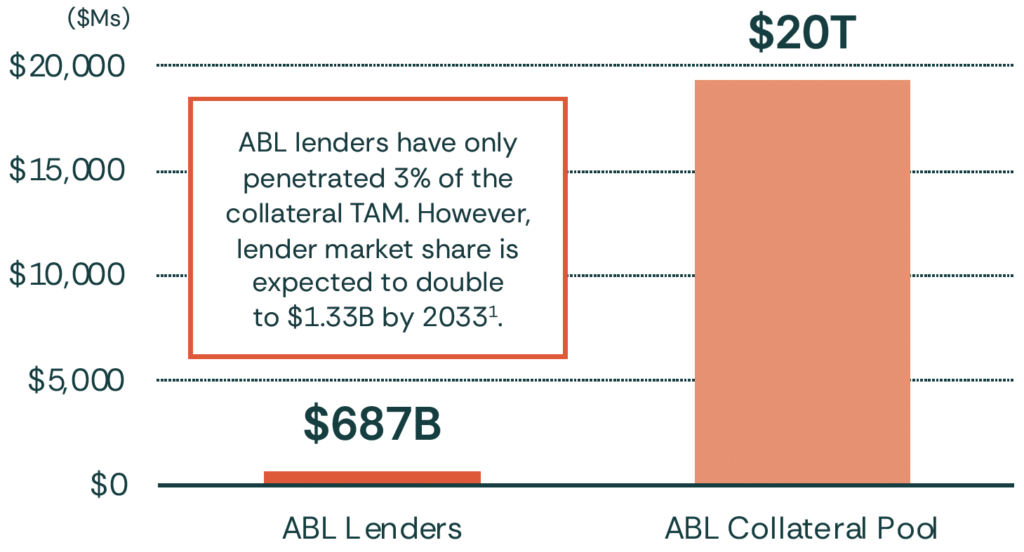

Private Credit has grown over ten-fold since the Great Financial Crisis1. However, the vast majority of capital has been deployed into Corporate Direct Lending. In contrast, asset-based lenders have only penetrated 3% of the total estimated market collateral pool2. Industry forecasts expect accelerating growth in ABL as allocators seek a complement and diversifier to Corporate Direct Lending and grow to $1.3Tn by 2036.

Asset-Based Lending Market Share

2) Pursuit’s Niche Focus Differentiates Among ABL Competitors

While the ABL markets are substantial in size, Pursuit’s focus is to seek only markets with limited competition from larger peers. Our investment thesis is to focus on the corners of the ABL market that are harder to finance or lend against due to capacity, complexity or cost challenges.

Pursuit’s long-term goal is to invest in just the top 0.001% of the $20Tn collateral pool that fits its rigid credit box and idiosyncratic niche framework.

This is a striking difference to large fund complexes who seek to manage hundreds of billions in capital in order to generate fee growth that their shareholders demand.

3) RIA Channel and Retail Access to Niche Asset-Based Income is Underserved

Only 6% of interval funds are primarily focused on asset-based finance3. These funds collectively managed $10bn of capital which implies only a 1% share of the current ABL lender market. Even fewer of these interval funds focus exclusively on niche asset-based lending.